The United States Dollar (USD) is one of the strongest and most widely used currencies in the world, especially in international transactions. It serves as the official currency of the United States and several other countries. While the dollar has deep historical roots in the U.S., the version of the currency we recognize today was first printed in 1914. Initially, the dollar’s value was determined by a bimetallic standard, backed by either silver or gold. A single dollar is divided into 100 cents and is popularly known as the “greenback” due to its distinctive green color. Though it is fundamentally an American currency, the dollar gained significant international prominence after World War I, eventually surpassing the British pound sterling as the world’s primary reserve currency following the Bretton Woods Agreement at the end of World War II. Today, the U.S. dollar remains dominant in global finance, serving as a benchmark against which the strength or weakness of other currencies is measured.

The History of the U.S. Dollar

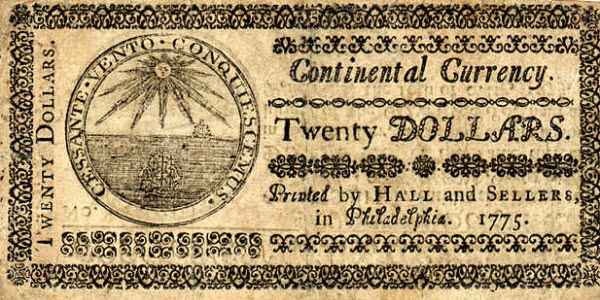

The U.S. dollar was introduced as an equivalent to the Spanish-American silver dollar, also known as the Spanish peso. These coins were made from rich silver mines in Spanish America, primarily minted in “Mexico,” “Peru,” and other locations, and were widely used across North and South America, Asia, and Europe from the 16th to the 19th century. The Spanish dollar was highly regarded globally as a trade currency. In 1785, the United States officially adopted the dollar symbol, and the minting of these coins began domestically in 1792.

In 1863, the U.S. government established the Office of the Comptroller of the Currency (OCC) and the Bureau of Engraving and Printing. These agencies were responsible for handling new banknotes, which started being printed by the Bureau of Engraving and Printing in 1869, replacing notes that were previously printed by private companies. By 1890, the U.S. Treasury took over the formal responsibility for issuing the nation’s legal tender, more than a decade before the creation of the Federal Reserve and the dollar currency we know today.

Interestingly, early U.S. dollars did not feature the faces of presidents. Initially, the newly formed government opposed the idea of depicting leaders on currency, associating this practice with European monarchies. It wasn’t until the early 20th century that the familiar portraits appeared on the dollar, following a law allowing the use of deceased individuals’ images on U.S. currency.

In 1913, the Federal Reserve Act established the Federal Reserve Bank in response to the instability of the currency system, which had previously relied on banknotes issued by individual banks. Around this time, the U.S. economy became one of the largest in the world, surpassing the United Kingdom, which was still controlling global trade and most transactions in pound sterling.

During this period, most developed countries pegged their currencies to gold as a means of stabilizing exchange rates. However, when World War I broke out in 1914, many countries suspended their use of the gold standard to finance military expenses and replaced it with paper money, devaluing their currencies. Despite this, Britain continued to adhere to the gold standard to maintain its position as a leading global currency, which led it to borrow money for the first time in the third year of the war. The United States became the preferred lender for many countries looking to purchase U.S. bonds denominated in dollars. By 1931, due to increasing economic pressures, Britain finally abandoned the gold standard, devastating the bank accounts of international traders who dealt in pounds. By then, the dollar had replaced the pound as the world’s leading reserve currency.

Just as the United States had joined World War I after a long period of fighting, it did the same in World War II. Before entering the war, the U.S. served as the primary supplier of arms and other goods to the Allies in exchange for gold, which made the United States the owner of the majority of the world’s gold by the end of the war. This situation made it impossible for countries with depleted reserves to return to the gold standard. Consequently, in 1944, representatives from 44 allied countries met in Bretton Woods, New Hampshire, to develop a foreign exchange system that would not harm any nation. The delegates decided that world currencies would no longer be tied to gold but could be pegged to the U.S. dollar, which was itself linked to gold. These decisions became known as the “Bretton Woods Agreement,” which established central banks with the authority to maintain fixed exchange rates between their currencies and the dollar. In exchange, the United States agreed to redeem dollars for gold upon request, with countries enjoying some control over their currencies in situations where their values became too weak or too strong compared to the dollar, allowing them to buy or sell their currency to regulate the money supply.

Thus, the U.S. dollar was officially crowned as the global reserve currency, backed by the largest gold reserve in the world thanks to the Bretton Woods Agreement. Instead of accumulating gold reserves, countries began to replace them with reserves of U.S. dollars. Because they needed a place to store their dollars, countries started buying U.S. Treasury bonds, which they considered a safe place to store money. However, this began to change with the outbreak of the Vietnam War. The demand for Treasury bonds, combined with deficit spending to finance the war and numerous domestic social programs, flooded the U.S. market with paper money. As concerns about the stability of the dollar grew, countries started converting their dollar reserves into gold. The demand for gold was so high that President Richard Nixon had to intervene and detach the dollar from gold, leading to floating exchange rates as we have today.

Today, the dollar remains the global reserve currency, with central banks holding about 59% of their reserves in U.S. dollars, according to the International Monetary Fund. This makes most people believe that the dollar is the strongest currency in the world. However, despite its position in global markets and the heavy reliance on it, the dollar ranked tenth in strength according to CMC Markets, which also ranked the Kuwaiti dinar as the strongest currency, while the British pound and the euro ranked fifth and eighth, respectively.

Why is it Called the Dollar and Symbolized as $?

The word “dollar” is the English version of “thaler,” a German word meaning “a person or thing from the valley.” This name was given to the first coins minted from silver mines in Bohemia in 1519, hence the name of the American currency.

The symbol $, typically written before the numeric amount of U.S. dollars, evolved in the late 18th century to shorten the letters “ps” for “peso,” the common name for the widely circulated Spanish dollar in the New World from the 16th to the 19th century. Eventually, the letters “p” and “s” were written on top of each other, creating the $ symbol. Another theory suggests that it was derived from the Pillars of Hercules on the Spanish coat of arms of the silver Spanish dollar, where the Pillars of Hercules appear as two vertical bars (||) with a cloth band swinging in the shape of an “S.”

Forms of the Dollar

Could Another Currency Replace the Dollar?

There are several alternatives that could potentially replace the U.S. dollar as the next global reserve currency. The “euro” is the most used reserve after the dollar and could potentially replace it if economic conditions move in its favor. However, its problem lies in the fact that the European Union lacks a centralized treasury, which could make this pursuit challenging. For now, the Chinese yuan could compete with the dollar, a goal that Chinese leaders strive to achieve. Nevertheless, the reserve status largely depends on the size and strength of the U.S. economy and the dominance of American financial markets worldwide. Thus, despite inflation and billions of dollars in debt, as well as rampant dollar printing, U.S. Treasury bonds remain the safest way to store money. The confidence in the U.S.’s ability to repay its debts makes the dollar the most redeemable currency for facilitating global trade.